Here’s an article crafted to meet your specifications:

Are you tired of relying on a single paycheck? Do you worry about economic downturns and job security? You’re not alone. Many people are seeking ways to build a more stable financial future, and income diversification is a powerful tool to achieve just that. Building multiple income streams can provide a financial cushion, accelerate your wealth-building efforts, and give you greater peace of mind.

Key Takeaways:

- Income diversification reduces financial risk by creating multiple revenue streams.

- Exploring options like side hustles, investments, and real estate can significantly increase your financial stability.

- Strategic planning and consistent effort are crucial for successful income diversification.

- Diversifying your income gives you more control over your financial future and can lead to greater financial freedom.

Understanding the Importance of Income Diversification

Relying solely on one source of income is like standing on a single leg. If that leg falters, you fall. Income diversification is the process of creating multiple sources of revenue, effectively building a more robust and resilient financial foundation.

Why is this so important? Imagine a scenario where you lose your primary job. Without alternative income streams, you’re facing immediate financial hardship. However, if you have rental income from a property, dividends from investments, or revenue from a side business, the impact of job loss is significantly lessened.

Income diversification isn’t just about mitigating risk; it’s also about capitalizing on opportunities. Each additional income stream can contribute to faster wealth accumulation and greater financial freedom. It allows you to pursue your passions, take on new challenges, and ultimately, have more control over your life. In today’s uncertain economic climate, with rapidly evolving job markets and unforeseen events, income diversification is no longer a luxury but a necessity for long-term financial well-being. Furthermore, with opportunities available through online platforms and digital marketplaces, building additional income streams has never been more accessible. The UK, for example, sees a rising trend in individuals pursuing side hustles and freelance work, often supplementing their primary income significantly and contributing to the overall gb economy.

Exploring Different Avenues for Income Diversification

The beauty of income diversification lies in its versatility. There’s no one-size-fits-all approach. The ideal strategy depends on your skills, interests, resources, and risk tolerance. Here are some potential avenues to explore:

- Side Hustles: These are income-generating activities you pursue alongside your primary job. They can range from freelance writing or graphic design to selling crafts online or offering consulting services. The possibilities are endless, and many side hustles can be started with minimal upfront investment. For example, if you have a knack for writing, platforms like Upwork and Fiverr offer opportunities to find freelance writing gigs. Similarly, if you’re skilled in a particular craft, Etsy provides a marketplace to sell your creations.

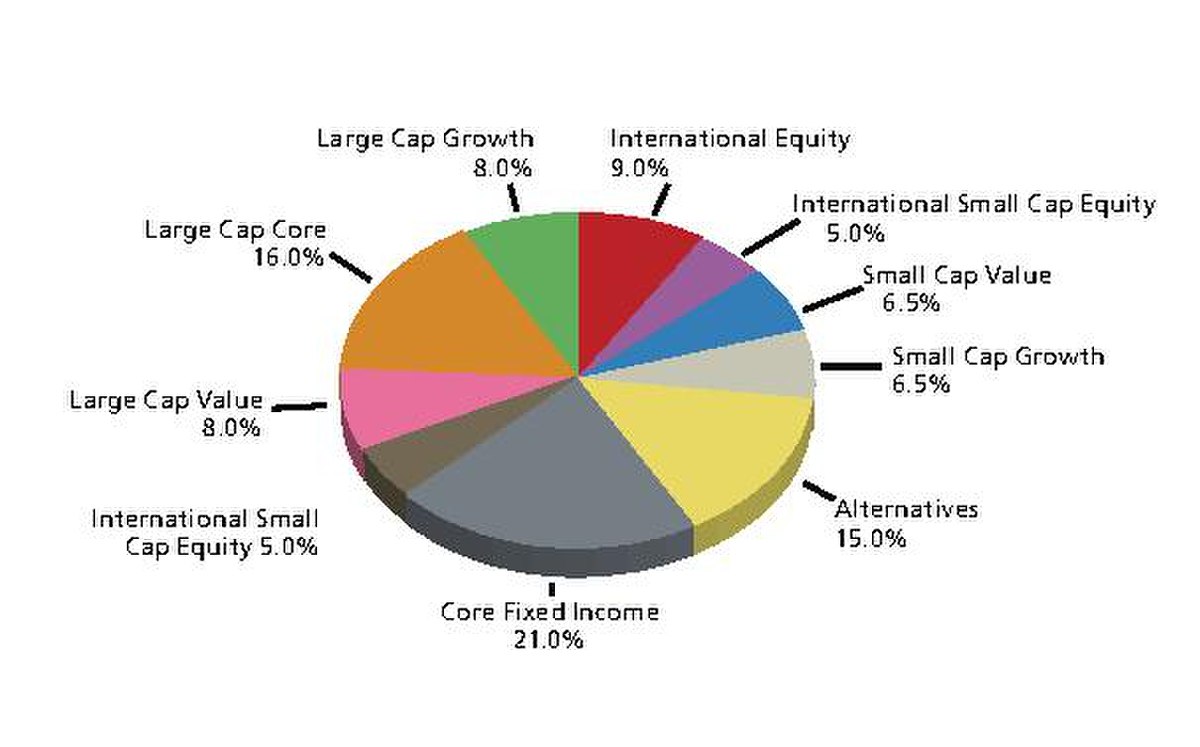

- Investments: Investing in stocks, bonds, and mutual funds can generate passive income through dividends and capital appreciation. Real estate investments, whether through owning rental properties or investing in REITs (Real Estate Investment Trusts), can provide both rental income and potential appreciation. Carefully consider your risk tolerance and investment goals before making any investment decisions. Consider consulting a financial advisor to create a diversified investment portfolio that aligns with your needs.

- Online Courses and Content Creation: If you possess specialized knowledge or skills, you can create and sell online courses or educational content. Platforms like Teachable and Udemy make it easy to host and market your courses. Similarly, creating valuable content on platforms like YouTube or blogging can generate income through advertising, sponsorships, and affiliate marketing. Building a strong online presence takes time and effort, but it can create a sustainable and scalable income stream.

- Affiliate Marketing: Partner with businesses and promote their products or services on your website or social media channels. When someone makes a purchase through your unique affiliate link, you earn a commission. Affiliate marketing can be a lucrative way to monetize your online presence, but it requires building an audience and creating engaging content that resonates with your target market.

Implementing a Strategic Plan for Income Diversification

Income diversification is not a haphazard endeavor. It requires careful planning and execution. Here’s a step-by-step approach to get you started:

- Assess Your Skills and Interests: What are you good at? What do you enjoy doing? Identifying your skills and interests will help you choose income streams that align with your strengths and passions. This will make the process more enjoyable and increase your chances of success.

- Set Realistic Goals: Start small and set achievable goals for each income stream. Don’t try to do too much too soon. Focus on building one or two income streams initially and gradually expand as you gain experience and confidence.

- Create a Budget: Determine how much time and money you can realistically allocate to each income stream. Track your expenses and income to ensure that your efforts are financially sustainable.

- Invest in Yourself: Continuously learn and improve your skills. Take online courses, attend workshops, and read books to enhance your knowledge and expertise. The more you invest in yourself, the more valuable you will become, and the more opportunities will open up to you.

- Monitor and Adjust: Regularly monitor the performance of your income streams and make adjustments as needed. Some income streams may be more successful than others. Be prepared to pivot and adapt your strategy based on your results.

Overcoming Challenges in Income Diversification

While income diversification offers numerous benefits, it’s not without its challenges. It requires time, effort, and discipline. Here are some common obstacles you may encounter and how to overcome them:

- Time Constraints: Juggling multiple income streams can be demanding. Prioritize tasks, delegate when possible, and learn to say no to commitments that don’t align with your goals.

- Lack of Expertise: You may need to acquire new skills or knowledge to pursue certain income streams. Be willing to invest in learning and seek guidance from mentors or experts in the field.

- Fear of Failure: It’s natural to feel apprehensive about trying new things. Embrace the learning process and view setbacks as opportunities for growth. Don’t be afraid to experiment and take calculated risks.

- Inconsistent Income: Some income streams may be less predictable than others. Be prepared for fluctuations in income and have a financial buffer to cover expenses during lean periods.

- Burnout: It’s important to maintain a healthy work-life balance and avoid burnout. Schedule regular breaks, prioritize self-care, and don’t be afraid to ask for help when you need it. Remember that income diversification is a marathon, not a sprint.

By acknowledging and addressing these challenges, you can increase your chances of successful income diversification and build a more secure and fulfilling financial future.