Are you dreaming of a secure financial future? Do you want to buy a home, retire comfortably, or simply have peace of mind knowing you’re prepared for unexpected expenses? The key to achieving these goals often lies in developing effective saving plans. Building wealth isn’t just about earning a high income; it’s about making smart choices with your money and letting the power of compounding work for you. This article explores various saving plans, providing insights to help you choose the ones that align perfectly with your individual circumstances and aspirations.

Key Takeaways:

- Saving plans are essential for achieving long-term financial goals like retirement, homeownership, and emergency preparedness.

- Different types of saving plans cater to various needs, including high-yield savings accounts, certificates of deposit (CDs), retirement accounts (401(k)s, IRAs), and investment accounts.

- Factors to consider when choosing a saving plan include your financial goals, time horizon, risk tolerance, and tax implications.

- Regular contributions, even small amounts, can significantly impact your long-term savings due to the power of compound interest.

Understanding the Different Types of Saving Plans

The world of saving plans is diverse, offering a range of options to suit different needs and preferences. Understanding these options is the first step toward building a solid financial foundation.

- High-Yield Savings Accounts: These accounts offer interest rates significantly higher than traditional savings accounts, making them a great place to park your emergency fund or save for short-term goals. The interest earned helps your money grow faster than it would in a standard savings account. Look for accounts insured by the FDIC to protect your deposits up to $250,000 per depositor, per insured bank.

- Certificates of Deposit (CDs): CDs are time deposits where you agree to keep your money in the account for a fixed period, ranging from a few months to several years. In return, you receive a fixed interest rate, which is typically higher than that of a regular savings account. CDs are ideal if you have a lump sum of money you don’t need immediate access to. There is usually a penalty for early withdrawal.

- Retirement Accounts (401(k)s, IRAs): These accounts are specifically designed for retirement savings and offer tax advantages. 401(k)s are typically offered by employers, while IRAs (Individual Retirement Arrangements) are opened individually. Contributions to traditional 401(k)s and IRAs are often tax-deductible, reducing your current taxable income. Earnings grow tax-deferred, meaning you don’t pay taxes until you withdraw the money in retirement. Roth 401(k)s and Roth IRAs offer tax-free withdrawals in retirement, but contributions are made with after-tax dollars.

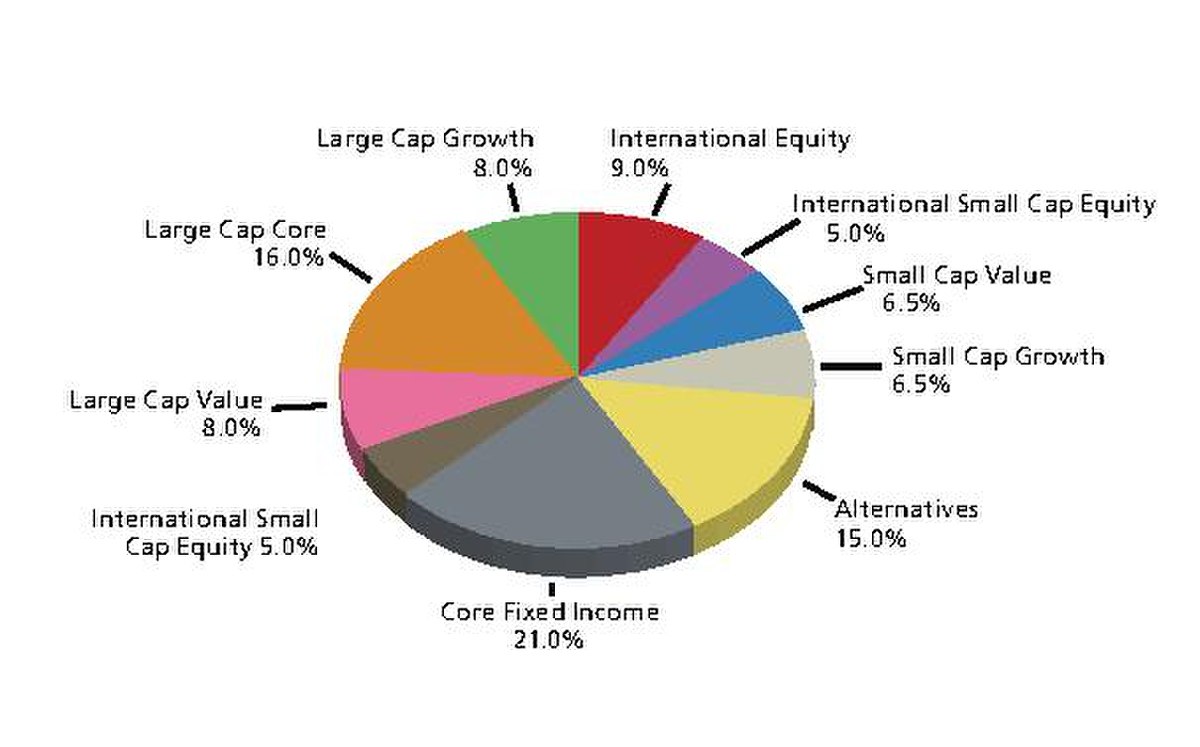

- Investment Accounts: Brokerage accounts allow you to invest in a variety of assets, such as stocks, bonds, and mutual funds. While investment accounts offer the potential for higher returns, they also come with higher risk. These accounts are suitable for long-term goals and those with a higher risk tolerance.

Factors to Consider When Choosing Saving Plans

Selecting the right saving plans depends on several factors unique to your financial situation. Consider the following:

- Financial Goals: What are you saving for? Is it a down payment on a house, retirement, your children’s education, or simply building an emergency fund? Different goals require different timelines and levels of risk.

- Time Horizon: How long do you have to reach your financial goals? If you have a long time horizon, you can afford to take on more risk, potentially leading to higher returns. If your time horizon is short, you’ll want to choose more conservative saving plans.

- Risk Tolerance: How comfortable are you with the possibility of losing money? If you’re risk-averse, you’ll prefer saving plans with guaranteed returns, such as CDs or high-yield savings accounts. If you’re comfortable with risk, you can explore investment options with the potential for higher returns.

- Tax Implications: Different saving plans have different tax implications. Some offer tax-deductible contributions, while others offer tax-free growth or withdrawals. Consider the tax benefits and drawbacks of each plan before making a decision. For example, in the UK there are several tax-advantaged savings accounts, sometimes compared in size to gb.

Maximizing Your Savings: Tips and Strategies for Saving Plans

Once you’ve chosen the right saving plans, the next step is to maximize your savings. Here are some tips and strategies to help you reach your financial goals faster:

- Set a Budget: Creating a budget helps you track your income and expenses, allowing you to identify areas where you can cut back and save more.

- Automate Your Savings: Set up automatic transfers from your checking account to your saving plans. This makes saving effortless and ensures you consistently contribute to your goals.

- Take Advantage of Employer Matching: If your employer offers a 401(k) match, take full advantage of it. This is essentially free money and can significantly boost your retirement savings.

- Increase Your Contributions Gradually: As your income increases, gradually increase your contributions to your saving plans. Even small increases can make a big difference over time.

- Reinvest Dividends and Capital Gains: If you’re investing in stocks, bonds, or mutual funds, reinvest any dividends or capital gains you receive. This allows your money to compound faster.

The Power of Compound Interest in Saving Plans

Compound interest is your greatest ally when it comes to building wealth. It’s the interest you earn not only on your initial investment but also on the accumulated interest. Over time, compound interest can significantly accelerate your savings growth.

Imagine you invest $1,000 in an account that earns 7% interest per year. After one year, you’ll have $1,070. In the second year, you’ll earn interest not only on the original $1,000 but also on the $70 in interest you earned in the first year. This snowball effect continues year after year, allowing your money to grow exponentially.

The earlier you start saving, the more time your money has to compound. Even small amounts saved consistently over a long period can grow into a substantial sum. Understanding and leveraging the power of compound interest is crucial for achieving your long-term financial goals through diligent saving plans.